The Stock Market Beginners Guide To Smart Investing

In the digital era, the financial industry is more reachable today than it has ever been. With only a few clicks on their cellphones, “online investing” lets anybody from all walks of life now join the stock market. This page seeks to clarify important ideas and offer a road map to anyone starting their investment path.

Understanding Stock Market Basics:

Starting an investment strategy most often involves the stock market. When you invest in share market, you are effectively purchasing a small portion of corporate ownership. This can be an exciting possibility since it lets you gain from the expansion and prosperity of companies you are interested in. However, one should approach this with caution and knowledge.

Essential Terminology:

For newbies, the stock market’s vocabulary might be intimidating. Let’s explore some basic terms:

NSE: This stands for one of the top stock exchanges in India, the National Stock Exchange.

Stocks: Stocks provide owners of a firm a claim to some of its assets and profits, therefore reflecting their ownership in a company.

Bonds: Debt securities published by governments or companies

Mutual Funds: Professionally controlled investment funds aggregating spelling from several sources.

Key Market Indices:

One word you come across quite often is nifty. This relates to the National Fifty, a benchmark index for Indian stocks that shows the weighted average of fifty of the biggest companies listed on the NSE.

Leveraging Technology for Investing:

An investment app is a great tool for people who want to be more involved in the process. These apps offer real-time market data, instructional materials, simple trading interfaces, and portfolio-tracking features.

Understanding Market Segments:

Following the nse Nifty 50, a well-known index including 50 of the largest Indian companies registered on the NSE. Many investors use this index to offer a brief view of the market’s state.

Considering several market divisions can help people who wish to diversify their investments. However, mid-cap and small-cap indices can provide different growth potentials and dangers; the nifty 50 shows large-cap stocks.

Exploring IPOs and Advanced Strategies:

An initial public offering (IPO) is another way one could invest in the stock market. This is the first time a private company sells shares to the general public, therefore enabling individual investors to engage in perhaps rapidly expanding businesses.

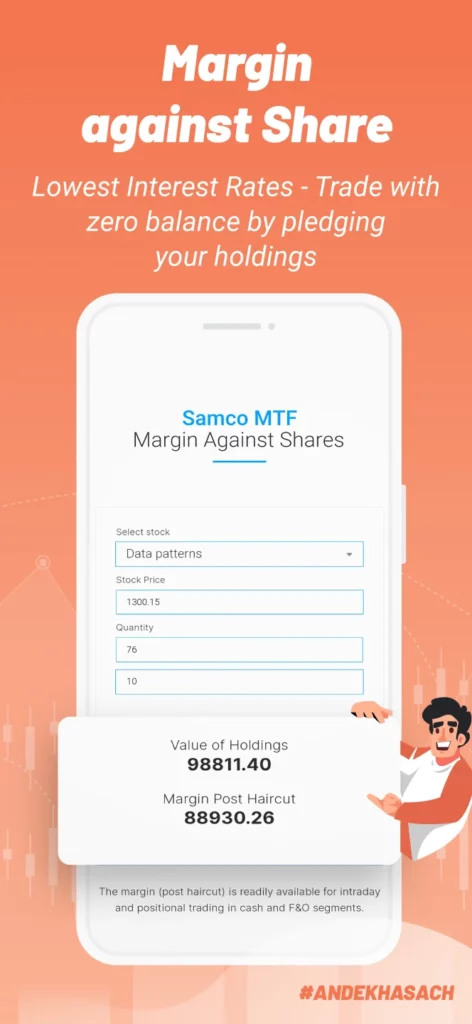

F&O (futures and options) can present opportunities for both hedging and speculative trading for individuals drawn to better trading techniques. These tools, meanwhile, carry more risks and require a better awareness of market dynamics.

The Role of Stock Exchanges:

A deeper study of the stock exchange will lead you to the National Stock Exchange, known as NSE. One of the primary stock exchanges in India, it is crucial for the national financial systems.

Conclusion:

Investing has several possibilities for financial success and expansion. Using tools like investment apps, knowing important market indices, and always learning can help you make wise judgments and move forward with your financial goals. The availability of financial markets has changed in great part to online investments. Anyone may begin their journey toward wealth development with sensible, informed investing methods equipped with the correct knowledge and tools. Remember that investing always involves risks; hence, it is advisable to do your homework and think about consulting experts before deciding on any major investment.